Understanding the information in a candidate’s background check is crucial for your hiring process. These insights can minimize risk and ensure a secure workplace. However, a background check, including a criminal background check, is just one aspect to consider. Employers must also know how to interpret background check results and utilize criminal background information to make informed decisions while complying with fair hiring laws.

Collaborating with a consumer reporting agency (CRA) like ACI Background Checks allows you to access accurate and up-to-date information about your candidates. It is essential to have proper procedures in place for candidates to provide written consent and address any inaccuracies in the criminal records you review, as mandated by the law. Moreover, it is vital to integrate criminal background checks into a fair, consistent, and compliant hiring process.

ACI Background Checks is here to assist you in comprehending how to read criminal background checks accurately and utilize them fairly. Here are four steps to help you get started.

What can you expect from a criminal background check?

Depending on your requirements, the report may encompass searches across national, federal, state, and county databases. Let’s explore each of these elements in detail.

National Databases: Searches thousands of digital databases across the country to find offenses at state and county levels.

Federal Databases: Searches all 94 federal courts in the country to look for federal crimes.

State Databases: Searches statewide databases for criminal records originating from courts within a particular state.

County Databases: Searches for digitized and non-digitized county records with the help of clerks, researchers, or automated databases.

Criminal background checks provide information on felony and misdemeanor convictions, as well as whether someone is listed on the sex offender registry, if included in the search.

Felonies are serious crimes, such as murder, rape, burglary, assault, kidnapping, arson, and theft (based on value). Felonies can be categorized by class, ranging from Class A through Class E or Level 1 through Level 5, depending on jurisdiction. Class A or Level 1 felonies are the most severe.

Misdemeanor charges encompass offenses like second-degree assault and burglary, trespassing, vandalism, indecent exposure, disorderly conduct, theft (based on value), issuing a bad check, filing false reports, and possession of a controlled substance (which could also be a felony, depending on the specific drug and quantity). Misdemeanors are often divided into Class A through Class C or Level 1 through Level 3, depending on the state.

Dispositions may also appear on criminal background checks which indicate the final outcome or current status of an arrest, prosecution, or case if pending.

The terminology surrounding dispositions can be perplexing, but two terms in particular can cause confusion. In a “deferred adjudication,” an individual may have entered into a plea agreement where they admitted to being “guilty” or “no contest” in exchange for the opportunity to fulfill probation or participate in a diversion program such as community service or drug/alcohol treatment, thus avoiding a conviction. Although they might have pleaded “guilty,” they have not been convicted, as the final outcome of their case is deferred until they complete, or fail to complete, the prescribed program. Successful completion of the program results in the dismissal of charges.

Another term you may come across is “nolle prosse,” which is Latin means “not willing to prosecute.” It refers to a situation where a prosecutor decides not to proceed with a case, often due to a determination of the defendant’s innocence or insufficient evidence for a conviction. When a disposition is nolle prosse, the case is considered dropped or dismissed.

Familiarize Yourself With Employment Background Check Terms, Definitions & Abbreviations

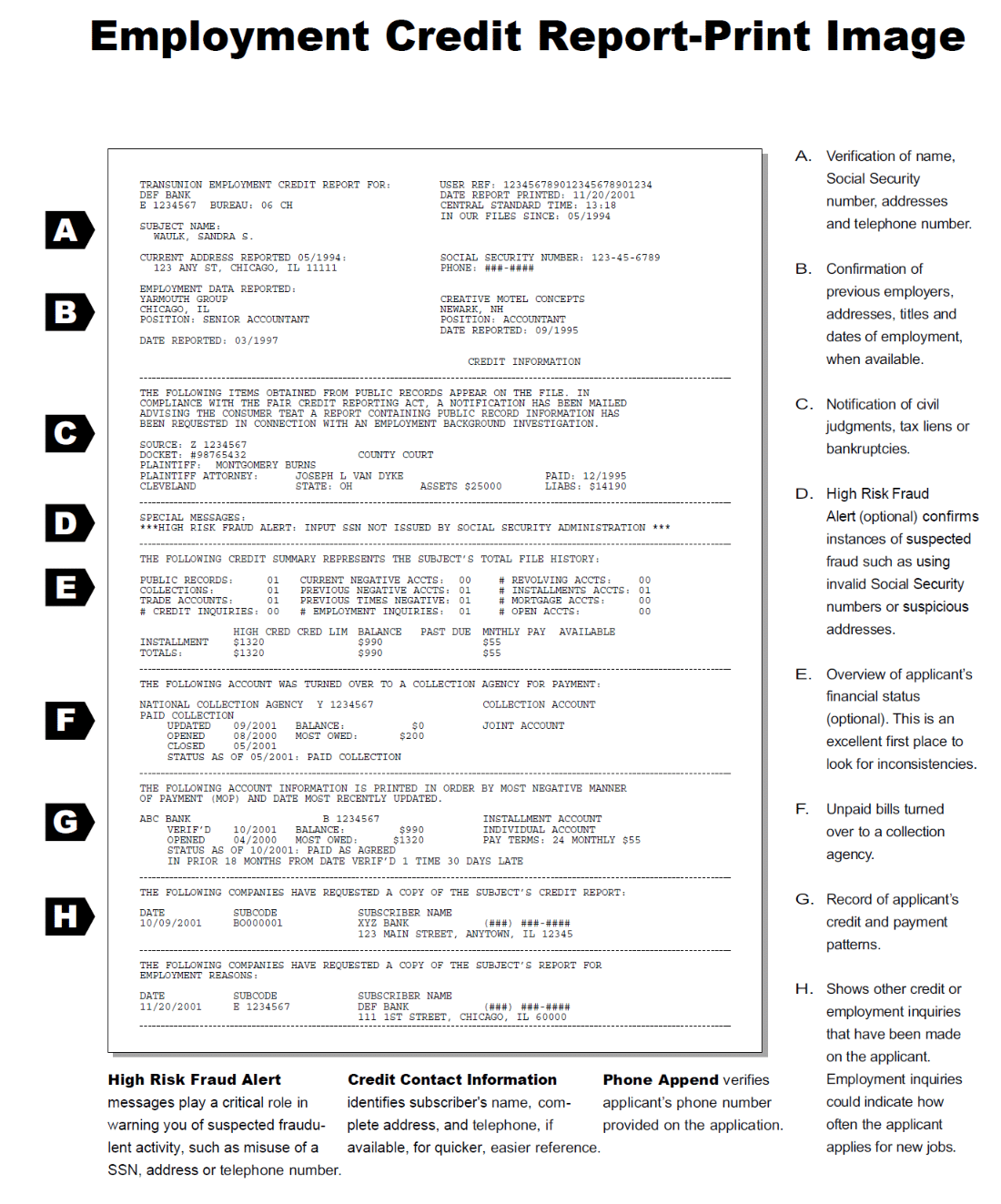

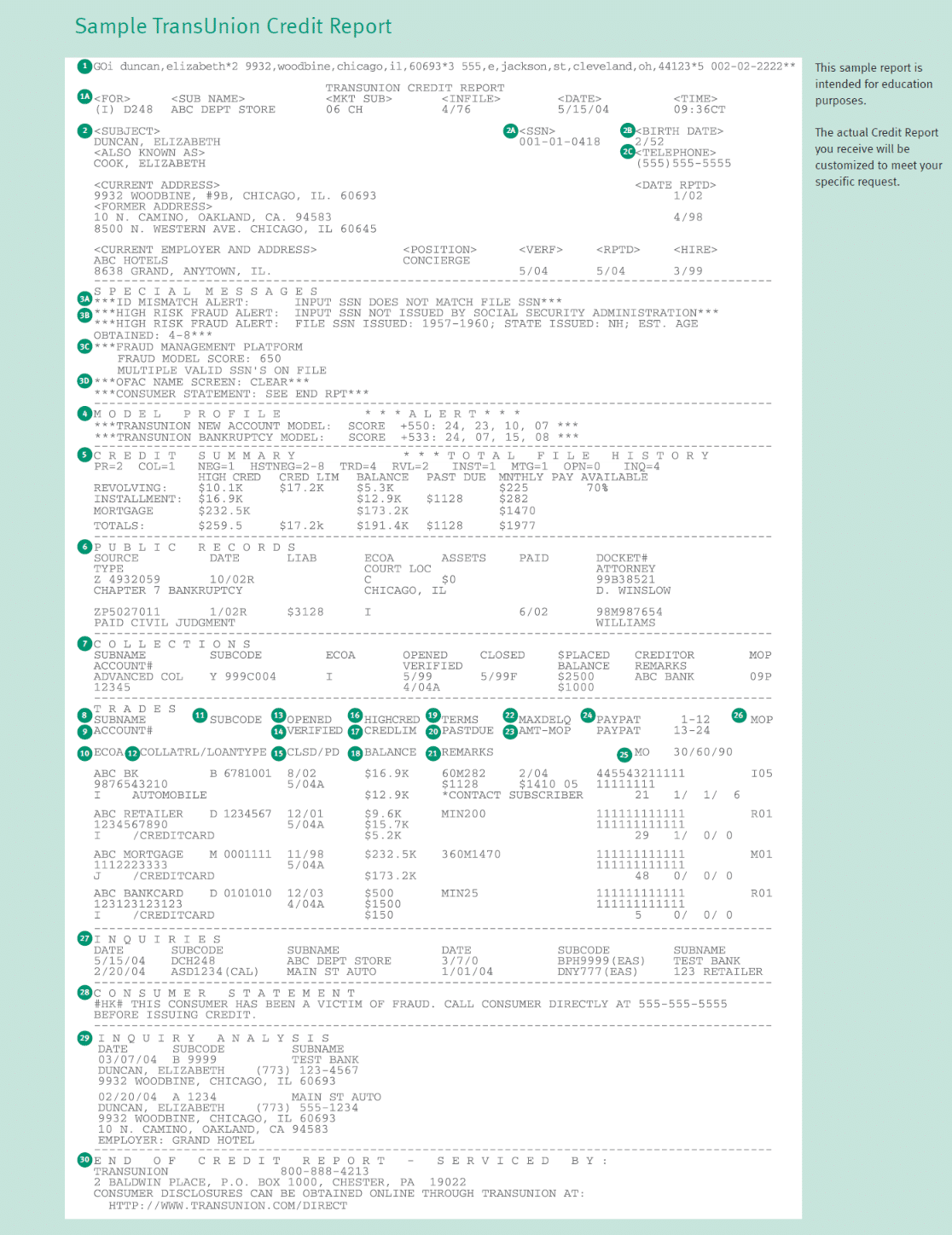

To provide you with a more comprehensive understanding of how to interpret an employment background check report, below is a sample credit report as well as some abbreviations and offense codes for criminal background checks which can vary from state to state. Also you can reference the U.S. Courts glossary of legal terms to better understand some of the information found on a criminal background check report.

1A: On every TransUnion Credit Report the inquiring subscriber’s TransUnion-assigned code, name, market area where the file resides within the TransUnion system, date the file was created, and inquiry date and time (Central Standard Time) of the inquiry are displayed.

2. Demographic information: Helps verify consumer identification by providing:

- Consumer’s name, plus any known aliases

- Current address and date reported

- Up to two previous addresses, date reported on first previous address

- If available, telephone number, and most

current and one previous employer (including

addresses, position and date employment was

verified, reported and/or hired)

2A. Social Security Number (SSN) if available

2B. Date of birth if available

2C. Phone Append

Special Messages

Highlights specific credit file conditions that may include:

- Presence of consumer statement

- No subject found

Some optional add-on products may also appear.

3A. An ID MISMATCH ALERT* (optional)

appears when the input address, SSN or surname does not match what is on file; or when a minimum of four inquiries have been made against the file within the last 60 days.

3B. HIGH RISK FRAUD ALERT* (optional)

appear if address, SSN or phone number have been used in suspected fraudulent activity; or if the information is inappropriate on an application, such as a commercial or institutional address; or if the SSN has not been issued by the Social Security Administration or is that of a deceased person as reported by the Social Security Administration.

3C. The FRAUD MANAGEMENT PLATFORM*

(optional) combines leading fraud-prevention capabilities of both TransUnion and Acxiom into one process. The solution accesses multiple references databases within both companies, resulting in a solution that provides a fraud score and messages. Additionally, business rule and decision criteria, and a decision engine and delivery interface are incorporated to provide an end-to-end solution.

3D. OFAC NAME SCREEN* (optional) is designed to assist with compliance of regulations set forth by the U.S. Treasury’s Office of Foreign Asset Control (OFAC). This service screens an applicant’s name against an enhanced OFAC database of specially designated nationals, drug traffickers, and money launderers.

4. Model profile

Displays empirically-derived scores to predict a consumer’s future credit performance. Other scores available estimate income, project recovery dollars and predict insurance risk.

Risk score factors are displayed numerically or in text. Up to four factors are disclosed and are displayed in order based on their relative impact on the final score.

***ALERT*** appears after Model Profile heading when Manner of Payment (MOP) is 7 or greater, a negative public record or a collection is present on the file.

5. Credit summary (optional)

Provides a “snapshot” of all activity on the consumer’s credit report.

- Available as an option covering either total file history or 12-month file history.

- “Total File History” or “12-Month History” is in the upper right hand corner of the credit summary depending on the option chosen.

From left to right, headers in the First Row read as follows:

PR: Total number of public records

COL: Total number of collection accounts transferred to a third-party collection agency. These accounts are identified with a Kind of Business (KOB) code of “Y”.

NEG: Total number of negative accounts (derogatory) with a current Manner of Payment (MOP) of 2 or greater

HSTNEG: There are two separate pieces of information in this field. Both relate to historical negative information on a tradeline. Historical negative information is defined as any Manner of Payment (MOP) of 2 or greater, occurring in any month. The first half of this field describes the number of tradelines which have historical negative information, and the second half describes the number of occurrences.

TRD: Total number of trades. TRD value is the sum of RVL, INST, MTG and OPN values

RVL: Total number of revolving and/or check credit accounts (account types “R” and “C”)

INST: Total number of installment accounts (account type “I”)

MTG: Total number of mortgage accounts (account type “M”)

OPN: Total number of open accounts (account type “O”)

INQ: Total number of inquiries

From left to right, headers on the second row

read as follows:

HIGH CRED: Highest amount ever owed on an account

CRED LIM: Maximum credit amount approved by credit grantor

BALANCE: Balance owed as of the date verified

PAST DUE: Amount past due as of the date verified or closed

MNTHLY PAY: From the “TERMS” field on the account; subscriber-reported monthly payment

AVAILABLE: Percent of credit available for revolving, check credit and open accounts. Field is calculated by subtracting balance from credit limit divided by credit limit.

TOTALS: Totals for second row headers are included for: Revolving, Installment and Mortgage Accounts (Open Accounts and Accounts Closed with a Balance are not shown on sample report)

Second Row: From left to right, headers on the second row

read as follows:

HIGH CRED: Highest amount ever owed on an account

CRED LIM: Maximum credit amount approved by credit grantor

BALANCE: Balance owed as of the date verified

PAST DUE: Amount past due as of the date verified or closed

MNTHLY PAY: From the “TERMS” field on the account; subscriber-reported monthly payment

AVAILABLE: Percent of credit available for revolving, check credit and open accounts. Field is calculated by subtracting balance from credit limit divided by credit limit.

TOTALS: Totals for second row headers are included for: Revolving, Installment and Mortgage Accounts (Open Accounts and Accounts Closed with a Balance are not shown on sample report)

6. Public records

Public record information is maintained on a consumer’s file in compliance with the Fair Credit Reporting Act (FCRA). This information is obtained from county, state and federal courts and includes civil judgments, state tax liens, federal tax liens, and bankruptcies.

The length of time each record is held on TransUnion’s database varies by the type of record.

7. Collections

Identifies consumer accounts that have been transferred to a professional debt-collecting firm.

Collection information includes the name of the collection agency providing information, consumer’s account number with the collection agency, collector’s Kind of Business (KOB) designators and TransUnion-assigned reporting subscriber number (all collection agency subcodes begin with a “Y”).

Trade information includes the following:

8. SUBNAME: Abbreviated name of credit grantor with whom consumer has an account

9. ACCOUNT#: Consumer’s account number with the credit grantor (partial account number will be returned)

10. ECOA: ECOA is a code representing the ownership designation on the account**

11. SUBCODE: Credit grantor’s Kind of Business (KOB) designator and TransUnion-assigned reporting subscriber number**

12. COLLATRL/LOANTYPE: Collateral for an installment loan, or the type of loan

13. OPENED: Date the account was opened

14. VERIFIED: Date of last update on the account**

15. CLSD/PD: Date of account status**

16. HIGHCRED: Highest amount ever owed by the consumer on that account

17. CREDLIM: Maximum amount of credit approved by credit grantor

18. BALANCE: Balance owed as of date verified or closed

Trade information includes the following:

19. TERMS: Number of payments, payment frequency, and dollar amount agreed upon

20. PASTDUE: Amount past due as of date verified or closed

21. REMARKS: Explanation of dispute or account credit condition, as reported by the credit grantor

22. MAXDELQ: Date on which the maximum level of delinquency for that account occurred

23. AMT-MOP: Dollar amount of consumer’s maximum delinquency and the Manner of Payment (MOP) rating at the time

24. PAYPAT: The subject’s payment pattern, which is his/her actual rating, or Manner of Payment (MOP), over a period of time. Depending on which option a customer chooses, either 24 months or 12 months of information will be shown. The default setting is 24 months.

25. MO 30/60/90: The four parts of this field summarize any delinquency on the account. The first column represents the number of months being summarized. The second, third, and fourth columns equal the number of times the subject has been 30, 60, or 90 days delinquent, respectively.

26. MOP: Type of Account (R, I, M, O, C) and Manner of Payment (MOP) code at which the account is currently reported.

27. Inquiries

Displays which companies have viewed the consumer’s credit file over the last two years. Includes date the inquiry occurred, inquiring subscriber’s TransUnion-assigned account number and name.

- Available in a one or two column display

- If two column, inquiries are displayed either left to right or top to bottom, by date

28. Consumer statement

Contains consumer’s explanation, in his/her own words, of facts or conditions affecting his/her credit file.

29. Inquiry Analysis (optional)

Returns the contact information provided by the consumer when applying for credit within the previous 90 days. Information returned includes the consumer’s name and current address, and potentially the consumer’s previous address, telephone number, and employment.

30. “Report serviced By”

This information should be used to direct consumers to the appropriate location in the event of an adverse action.

Title

Implement Fair Hiring Policies

In addition to understanding how to read a criminal background check, knowing how and when to use criminal background checks as part of your hiring process is important. Employers must comply with federal and local fair hiring laws and regulations to ensure a fair, non-discriminatory hiring process.

Your company should have consistent and compliant hiring processes in place as well to prevent discrimination and to avoid litigation and penalties from federal or local agencies. Criminal background checks can be of great value to employers but only when they are applied fairly and compliantly.

Among the laws and regulations to consider:

- Federal Fair Credit Reporting Act (FCRA)

- Equal Employment Opportunity Commission (EEOC) & Title VII

- Ban the Box & Other Fair Hiring Laws

One way to make the process of running and interpreting a criminal background check less mystifying—and more productive—is to work with a trusted employment screening provider like ACI Background Checks. ACI Background Checks also takes multiple steps to make reports easier for employers to read and understand.

Contact us to learn more on how we can help you access and use criminal background checks without confusion or compliance issues.